Separate Finances, Money Dates & Tori Dunlap's Best Money Advice for Couples

Money can often feel stressful. It’s stigmatizing and high-pressure, you could pretty much always use a little more than you got and you can’t always agree on the best way to use what you do have. It makes sense that it’s something couple’s tend to fight about more often than not.

But it doesn’t have to be the most stressful thing in the world. Money can, in fact, be something that frees you from toxicity (who doesn’t appreciate the genius of the “get-out” fund?) at worst and at best can be a testament to the collaboration and shared goals in your partnership.

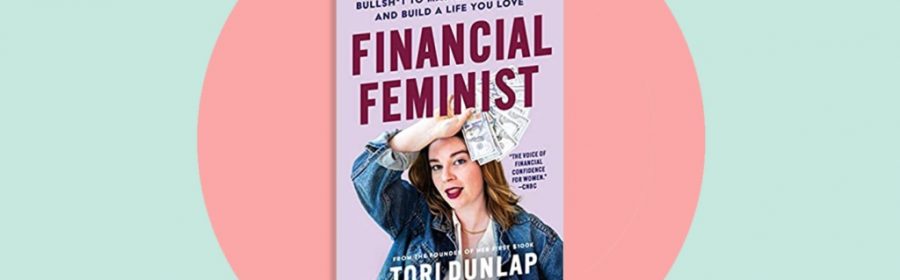

Tori Dunlap, financial expert, investor and founder of Her First $100k, caught up with SheKnows just a few days before the release of her new book Financial Feminist to talk about just that: Money problems and how to even begin to address them (solo and in a partnership).

Dunlap isn’t shy talking about money — in her book or IRL — because she’s found a way to thoroughly reframe personal finances for all kinds of people from this hyper-stigmatized, guilt- and anxiety-inducing thing to something that can give them power, flexibility, independence and a means to really choose the kind of life they want for themselves and their families.

But that said, she maintains that your personal finances are just that personal. In fact, she says that if you were to take a shot each time she says that phrase (“personal finances are personal”) in the book, “you’d be on the floor by chapter three.”

“I truly do believe that everybody’s situation is different and that there is no one-size-fits-all thing to money,” Dunlap says. “There are for me a couple of hard and fast rules: So one is you need to save an emergency fund before anything else. Actually, before you pay off any debt, you need an emergency fund. One of my other hard and fast rules is that people in a partnership should always maintain a little bit of money, that’s theirs. You should never completely combine finances.”

She cites tons of reasons for why this makes sense, from the darker reality that sometimes your relationship may not be the right one or the most healthy one and you need to be able to keep yourself safe and even in milder situations to just give yourself an avenue to leave an unhappy situation when you want to leave.

“No one wants to think that their situation would turn abusive or violent, but I have unfortunately plenty of emails that say differently where money is the reason women can’t get out of that situation,” Dunlap says. “Money means choices and it means options. But also maybe you love this person and you just don’t want to be in a relationship with them with them anymore. Maybe you want a one-bedroom apartment on your own, but you don’t have the money do that. I actually see plenty of people who are sometimes my friends who come to me they’re like, ‘yeah, I’m not super happy. But it’s not terrible. And I can’t afford $2,000 a month, but I can afford 1000.’ So they’ll stay in relationships they don’t want to be in.”

And then there’s also just that it’s more fun to have money (a smaller amount than what’s put aside for shared expenses and shared savings goals) for your own purchases that don’t necessarily need to be made by committee.

“You don’t want to have to counsel your partner on every single purchase you make, right? There should be separate money — like my dad has his golf money, my mom has her like scrapbooking money. And that is the money that they can spend on golf or scrapbooking without counseling,” Dunlap says. “I find that this leads to a lot of better, healthier relationships, because the person still has their own identity and their own independence.”

And her last reason, which is admittedly gooey but also pretty dang romantic, is that having the separate finances and a sense of financial health for yourself allows you to really, fully choose your partner and your living situation. Full stop. There’s no question of needing the split rent or the split costs (although you can benefit from ’em) to survive, you’re with your person because you don’t want to be without them.

“The last thing I would want is to feel like someone is in a relationship with me purely because or partially because they can’t leave financially,” Dunlap says. “So I think actually, it’s a very generous thing to be able to say ‘no, I’m in this relationship, because I love you and I love being here. Yeah, hypothetically, I could leave. But I’m not going to.’ I don’t want that to ever be in doubt or question.”

So this sounds really beautiful and smart, but as with all things in relationships it can be hard to really imagine how you can make these kind of attitudes your own and make sense in your own dynamic. Dunlap has some advice for that too: Schedule a standing money date.

“Ultimately, you need to be talking about money in your relationship way before you even get married or become like legally partnered — like this needs to have be a conversation and an ongoing conversation,” Dunlap says. “[A money date] is like once a month, non-negotiable, where you’re sitting down and you’re looking at your money. And if you are managing money with a partner, you’re doing this with them. You’re looking at your credit card statements, you’re looking at your investment portfolio performance. And you’re also having conversations about money: How do we use money as a tool to build the life that we love?”

And that last framing of money — the positive dreaming, goal-setting and vision of a future where you have just one less thing to stress over in your household? That’s something you’ll find throughout Dunlap’s book. Think of it as a call to sit with an examine the stories you tell yourself about your own finances, the things you’ve internalized and struggled with and look at how you can transform it for yourself — and enjoy the ripple effect of how that transformation will benefit your relationship and your family.

Your financial health journey is also part of your mental health journey. Check out these apps for a little extra mental health TLC:

Source: Read Full Article